Autonomous Learning Investment Strategies

Explore the future of investment advisory with SYGMA1—our proprietary neural network AI that powers autonomous learning strategies to deliver real-time, data-driven insights. Stay in full control of your portfolio while benefiting from precision-guided recommendations tailored to your risk profile and market conditions.

Autonomous Learning Investment Strategies

An Autonomous Learning Investment Strategy (ALIS) is an advanced investment advisory approach that leverages artificial intelligence (AI) and machine learning to deliver real-time, data-driven recommendations, empowering investors to make more informed decisions while retaining full control over their portfolios.

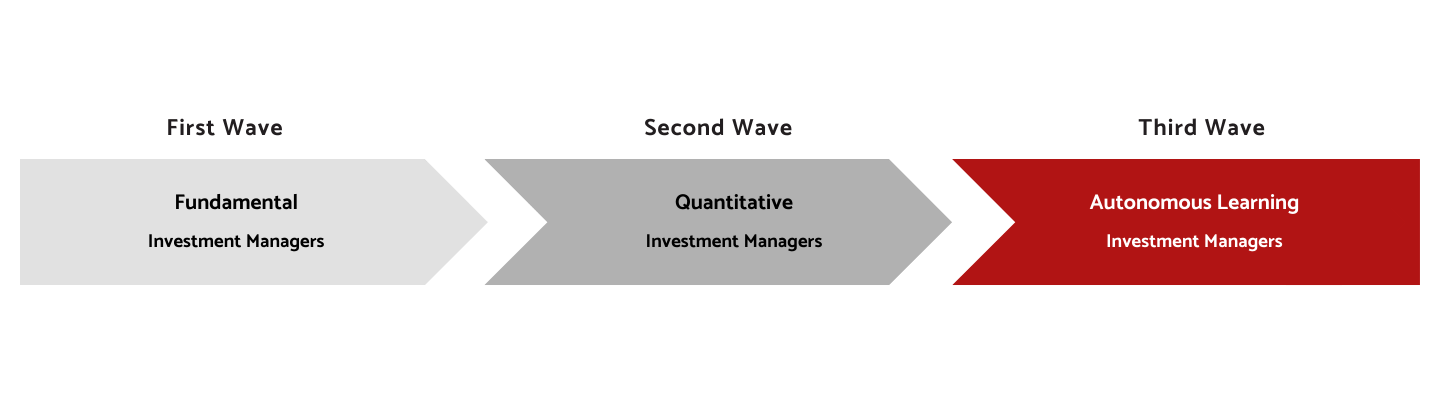

Unlike traditional investment methods that rely on either human discretion or static quantitative models, ALIS represents the ‘third wave’ of investment strategy evolution—a leap beyond conventional discretionary and rule-based investing. By continuously analyzing historical data, monitoring live market conditions, and adapting autonomously to emerging trends, ALIS uncovers patterns and signals that often go unnoticed by human analysts.

Through this AI-driven advisory framework, SYGMA1, our proprietary neural network platform, delivers intelligent, adaptive insights tailored to your risk profile and financial goals. Investors benefit from improved performance visibility, enhanced risk management, and exposure to cutting-edge investment intelligence—all while maintaining full ownership and decision-making authority.

ALIS is not just a strategy—it’s a future-proof methodology that aligns next-generation technology with investor empowerment.

SYGMA1: The NeuRal Network AI

SYGMA1 stands for Systematic Global Macro – Edition 1, representing the first generation of our proprietary AI system, engineered to power our AI-driven investment advisory services. Grounded in a Systematic Global Macro framework, SYGMA1 is designed to analyze global market forces and identify strategic opportunities across asset classes, currencies, commodities, and indices.

At its core, SYGMA1 leverages Artificial Neural Networks (ANNs) to fuel our Autonomous Learning Investment Strategy (ALIS). These advanced networks continuously scan and process vast quantities of market data in real time—detecting price patterns, volatility shifts, and macroeconomic correlations that drive intelligent, unbiased trade recommendations.

Inspired by the way the human brain processes information, SYGMA1 is built on deep learning architecture, consisting of layered nodes that learn from historical patterns and real-time inputs. As markets evolve, SYGMA1 evolves too—adapting to new conditions, minimizing noise, and fine-tuning its output through feedback mechanisms akin to “learning from experience.”

Unlike static models and discretionary managers, SYGMA1 delivers adaptive, insight-rich signals. It helps investors stay ahead, while maintaining full custody and control over their accounts. This ensures a transparent, intelligent advisory experience, where decisions are powered by advanced technology but always rest in the hands of the investor.

Our Strategies

Strategy Description

SYGMA-ABR is a proprietary Systematic Global Macro strategy designed to support investors seeking consistent daily income through an advanced, non-discretionary advisory framework. Developed by Trajan Capital, this AI-powered model fuses real-time macroeconomic analysis with adaptive trading signals to identify and act on opportunities across global markets.

At the heart of SYGMA-ABR is an Absolute Return Profile—engineered to generate steady performance regardless of whether markets rise or fall. Its market-neutral approach focuses on short- and mid-term timeframes, executing strategic, algorithm-informed trade recommendations aimed at capturing gains from macro shifts, volatility patterns, and momentum trends.

By leveraging data-driven methodologies, SYGMA-ABR continuously recalibrates its models in response to economic indicators, policy changes, and price action across currencies, indices, commodities, and fixed income instruments. This makes it highly resilient and responsive—even in unpredictable conditions.

As part of our AI investment advisory suite, SYGMA-ABR allows investors to maintain full control of their accounts while benefiting from cutting-edge signal generation that aims to deliver reliable daily returns and long-term risk-adjusted growth.

SYGMA - ABR

Performance

Strategy Description

SYGMA-PRO is the elevated counterpart to our SYGMA-ABR strategy—built on the same Systematic Global Macro foundation but tailored specifically for experienced, professional investors seeking higher return potential through controlled leverage.

What sets SYGMA-PRO apart is its strategic application of enhanced leverage, carefully balanced with robust, AI-informed risk management protocols. These advanced safeguards are meticulously engineered to mitigate exposure while preserving the performance advantages that leverage can offer in high-conviction trades.

Designed for investors well-versed in derivatives and complex instruments, SYGMA-PRO delivers a nuanced investment advisory experience—one that combines the intelligence of autonomous learning systems with the discretion and oversight of the investor. Trade recommendations are informed by SYGMA1’s deep-learning algorithms and systematically calibrated to manage volatility, tail risk, and liquidity stress.

With its targeted application of leverage, market-responsive strategies, and transparent account-level execution, SYGMA-PRO aligns with the needs of institutional and sophisticated investors looking to optimize risk-adjusted returns in dynamic global markets—while remaining fully in control of their capital.

SYGMA - PRO

Performance

Strategy Description

SYGMA-E is a bespoke Systematic Global Macro strategy currently in the incubation phase, purpose-built for precision trading within the energy markets. Designed specifically for energy producers and related enterprises, SYGMA-E acts as a strategic hedge against market volatility—while simultaneously unlocking opportunities for supplemental income generation.

By aligning with the unique operational and financial exposures of the energy sector, SYGMA-E offers a tailored AI-powered advisory framework that enhances financial resilience in the face of commodity price swings, geopolitical shocks, and supply chain disruptions.

Unlike generic hedging tools, SYGMA-E incorporates deep-learning analytics and macroeconomic signal processing to deliver intelligent trade recommendations that are aligned with your production cycle, revenue goals, and market exposure.

This strategy reflects our commitment to delivering customized advisory solutions for high-impact industries. Once fully deployed, SYGMA-E will help energy companies navigate market dynamics with greater precision—optimizing performance, reducing downside risk, and supporting long-term capital stability in a complex, fast-moving energy landscape.